Iowa offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Iowa Renewable Energy Tax Credits

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Iowa Government

State Capitol

1007 E Grand Ave.,

Des Moines, IA 50319

(515) 281-4102

[email protected]

Hours: M-F 8:00am – 5:00pm

MidAmerican Energy

666 Grand Ave.

Des Moines, IA 50309

Residential Customer Service

(888) 427-5632

Business Customer Service

(800) 329-6261

[email protected]

Hours: M-F 7:00am – 6:00pm

Iowa Energy Office

Iowa Economic Development Authority

1963 Bell Avenue, Suite 200

Des Moines, IA 50315

(515) 348-6200

[email protected]

Hours: M-F 8:00am – 5:00pm

Des Moines Weather Bureau

9607 NW Beaver Drive

Johnston, IA 50131

(515) 270-2614

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Solar Sales Tax Exemption | 6% sales tax exemption | Applies to specific solar equipment |

| Solar Property Tax Exemption | Upgraded property value tax is exempt for 5 years | Applies to property upgraded with solar |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Iowa Clean Energy

Solar Energy System Tax Credits

Energy Efficiency Programs

Renewable Energy

Clean Cities Program

Energy Efficiency and Conservation Block Grant Program

Power Outage Map

Contact

Iowa Department of Natural Resources

6200 Park Avenue

Suite 200

Des Moines, IA 50321

Business hours:

8:00am-4:30pm CST

Mon-Fri

Phone: (515) 725-8200

Fax: (515) 725-8201

Iowa Key Solar Incentives and Benefits for Homeowners

According to the Solar Energy Industries Association,4 Iowa has 645.7 MW of solar power installed in 80,929 homes, accounting for 0.91% of the state’s electricity supply, yet the state ranks 33 in the nation for solar adoption.

So far, the state and federal governments have contributed immensely to adopting solar power by offering incentives like tax credits and tax exemptions for residential solar installation.

Understanding Iowa solar incentives is the first place to start before investing in a solar power project.

Several incentives are available to Iowans, including the Federal Solar Investment Tax Credit, Iowa Net Metering, property tax exemption, and other Iowa local incentives.7

This comprehensive guide details everything you need to know about state and federal solar incentives for residential solar installation in Iowa.

Programs That Iowa Is Using To Make Solar Panels Affordable to Residents

One of the programs that Iowa is using to make solar panels affordable to residents is through a solar panel tax credit program.

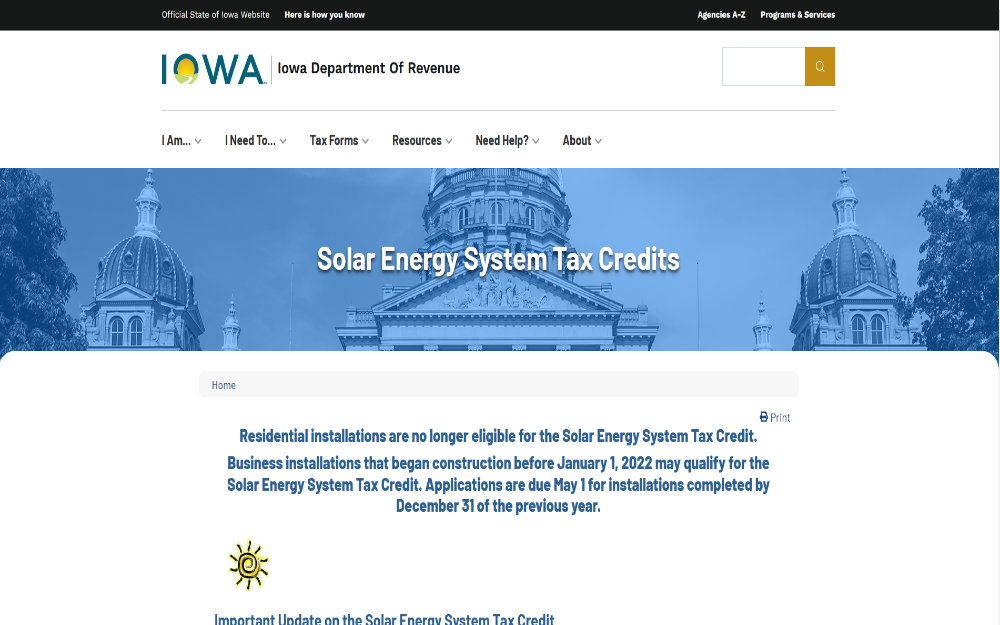

Iowa had the most generous state solar tax credit as of 2021, allowing residents to get up to 50% of their federal investment credit tax (ITC) value as their state ITC. Unfortunately, this program expired in 2021, when the federal ITC program ended.11

The Iowa State solar tax credit is yet to be renewed, even though the federal ITC program is back.

Since Iowa no longer offers state investment tax credit for residential solar installation, residents can benefit from the federal solar investment tax credit,2 provided by the federal government to all states across the U.S.

This means that every homeowner who has installed a solar project can claim a return of up to 30% of their project cost in the tax year they completed installation.

For example, if your project cost is quoted at $20,000, you can claim a federal return of $6,000 when you file your taxes for the year you completed the project.

To apply for this solar tax credit, download the required Form 5695 and provide the information. You must also calculate your credit, add any rollover credits from the previous year, and indicate any tax liability limitations before submitting it.6

How Solar Credits Work With Taxes

Understanding how solar credits work with taxes is vital because you can enjoy all the benefits that come with it. Every solar incentive offered in Iowa State works differently with taxes, and this comprehensive guide breaks them down for you.

For example, the federal solar ITC is a tax liability requiring you to claim on the following tax year as you file your taxes. On the other hand, a solar sales tax exemption applies to qualifying equipment you buy when installing solar systems.

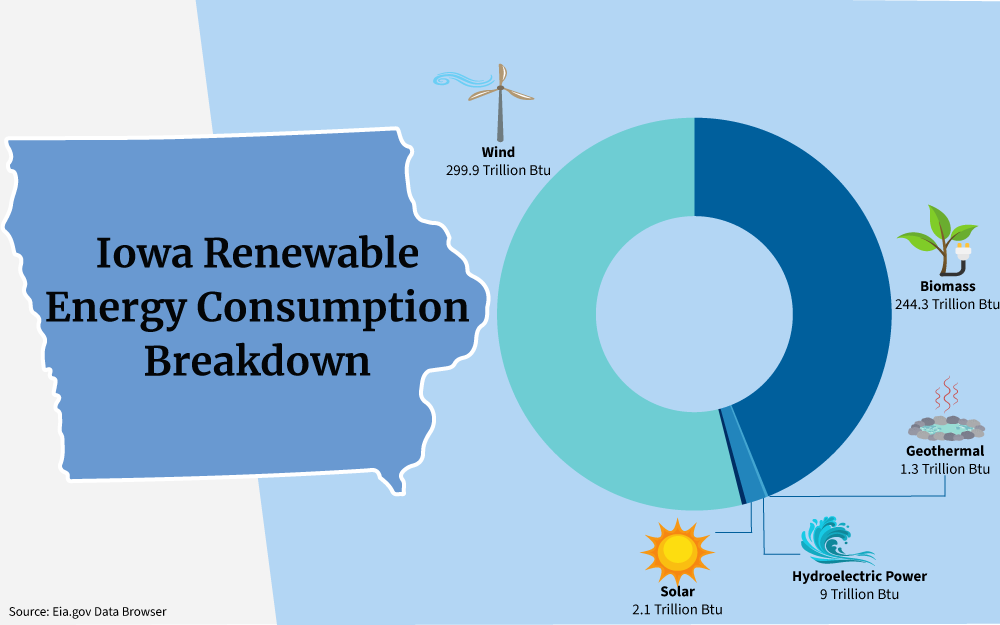

According to energy experts, the adoption of solar power in Iowa is expected to maintain steady growth, attaining a total installed solar capacity of 1,315 MW across the state.4 This is because Iowa has different programs and government solar incentives that residents can use to get solar panels at an affordable rate and embrace the use of solar energy.7

Federal Solar Tax Credit

A tax credit helps you offset the amount you owe in taxes. Thus, the federal ITC is only claimable when filing your taxes and used to pay your taxes for the year.

The amount is not a tax refund, so you cannot access it for other uses.

Also, tax credits do not work as tax deductions that affect your taxable income but as a tax liability that can help you reduce your taxes.6

Think of it like this. If your 30% tax credit amounts to $3,000, and your taxes for the year amount to $4,000, when you claim your tax credit, your taxes are reduced by $3,000, and you only pay $1,000.

If your taxes are less than $3,000 that year, and you claim your tax credit, the remaining tax credit is rolled over to the following year. You can claim it on your next year’s taxes, and the remaining amount keeps rolling to the following year for up to five years.

While the tax credit doesn’t help with the upfront cost of installing the solar system, it allows households to save an average of $7,500 in taxes.8

Solar Sales Tax Exemption

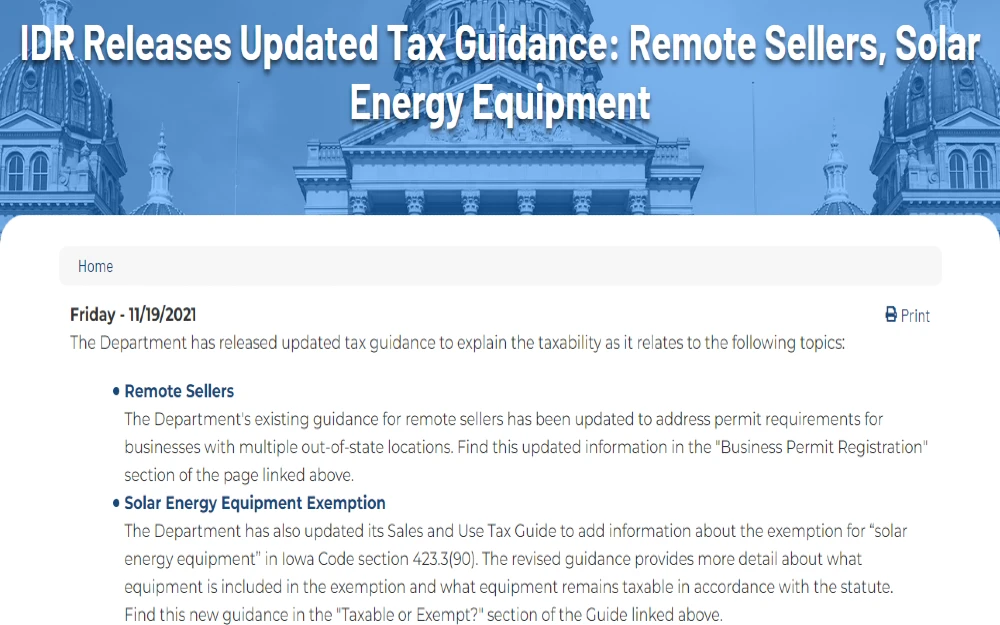

Solar energy equipment digs deep into your pocket when purchasing. Therefore, the Iowa State government has a law allowing solar equipment to enjoy a 6% sales tax exemption.12

This means you can buy equipment tax-free, saving some bucks on every piece.

For example, if you are installing a 9kW solar system, you may save up to $1,745 on equipment alone. However, not all solar energy equipment is eligible for this program.

The tax exemption law applies to equipment that collects, converts, and transmits solar energy.

The best thing about this incentive is that you don’t have to fill out any papers or wait for approval. You only need to find equipment that qualifies for the sales tax exemption and purchase it for your solar installation project.

Solar Property Tax Exemption

Are you considering adding value to your property for future disposal and trying to figure out what to do? Installing a solar energy system increases your property’s value and qualifies you for property tax exemption for five years after installation.9

Considering that Iowa has a high property tax rate of 1.29% compared to other states, an exemption from additional taxes is a welcome deal.

Your property tax assessor only considers the property’s value before you install the solar system and avoid a tax increase for five years.

Net Metering

Solar energy is only reliable when the sun shines brightly, and the panels can generate much energy. Therefore, the government of Iowa allows solar users to contribute to the national grid when their panels generate excess energy while earning energy credits.

When solar energy is unreliable in stormy seasons, residents can use their credits to pay for the electricity they use from the national grid. This incentive is tremendous because solar energy users can “sell” their power to the grid and recover it when needed.

The net metering process is quite complicated,13 but your utility company can guide you through it and have them create a solar interconnection for you. You enjoy the best of both worlds – solar energy and a reliable grid system.

Other Local Solar Incentives (Iowa)

Residents using solar energy enjoy incentives like solar panel rebate Iowa from their municipalities, solar installers, or solar companies seeking to promote their products and services. Most of these incentives may only be available in some parts of the state, so you should look for what is available in your area.

For example, residents in the City of Ames can receive a rebate in cash depending on how much power they generate at the utilities’ peak time, usually 5 p.m.17

To ensure you don’t miss out on any available incentives, call your solar installers, utility providers, or even the municipality to find out those available.

Eastern Iowa REC: Residential Rebate Programs

This utility provider offers rebates and free enrollment for customers who make renewable energy upgrades to their homes.

For example, types of purchases covered include:

- EV chargers

- Heat Pumps

- Water Heaters

Customers are required to apply for the $500 rebates within six months of the purchase to qualify.

Waverly Utilities: Solar Water Heater Rebate

Waverly Utilities also provides a rebate for the installation of a solar water heater.

The rebate is capped at $3500 and residents who want to take advantage of these types of Iowa solar incentives should apply for the rebate before the water heater or solar system is installed.

Requirements for Obtaining Solar Credit in Iowa

The federal government’s solar incentives allow residents with solar power systems to gain from their investments.

So, what are the limits on the solar tax credits and rebates?

There are no limits to how much you can get as solar tax credits and rebates, as long as you qualify for them.

You must meet the following requirements for obtaining solar credit in Iowa through the federal solar ITC.

- The solar energy system must be installed in your home, whether it’s your primary or secondary residence.

- The solar system should be installed and in operation between January 1, 2022, and December 31, 2032, as per the Inflation Reduction Act of 2022.15

- The installed solar system must belong to you, whether you paid for it in full or are on a payment plan. You cannot claim tax credits on a solar lease or a power purchase agreement.

- Tax credits only apply to the original installation. Therefore, you cannot claim tax credits for one system twice.

For example, you cannot reclaim tax credits if you move homes and re-install the system.

If you are unsure whether you qualify for the incentive, it’s important to engage a tax professional or a solar installation company for guidance. You may also need a hand when completing the form, ensuring you follow all the Form 5695 instructions.

Here are some steps to follow when applying for solar credit tax:

- Go to the IRS website and download the residential solar credit tax form labeled Form 5695. Ensure that you understand all the instructions before filling it out.

- In the Part 1 section of the form, you’re required to enter your qualified solar electric property costs as shown in your contract. This information is entered on line 1 and is useful in lines 6 and 7, where you calculate your credit.

- Enter any other renewable energy sources you have and whether you had a credit rollover from the previous year. If none of that information applies to you, skip to the lines with the next requirement.

- If you have any tax liability limitations, calculate them using the Residential Energy Efficient Property Credit Limit Worksheet and enter your findings on line 14.

- This information is important for the calculation in lines 15 and 16. Once the calculations are complete on Form 5695, transfer the info on line 15 to Form 1040.

Remember that the federal ITC is a one-time incentive that applies when you file your taxes for the year you completed installation. It offsets your taxes for that year, and the remaining amount rolls over to the following year, up to five years.

In Iowa, is there a deadline for applying for tax credits?

The federal government allocates $5 million every year to Iowa for solar tax credits to new residential solar owners. Therefore, timely applications done before May 1st of that tax year are considered for the waitlist.

How Much Does It Cost for Solar Power Systems in Iowa?

Investing in photovoltaic energy is a cost-intensive venture that requires you to consider several factors before diving into it. Some factors include the necessary solar panel materials and their size, available solar financing options, and installation labor costs.

So, how much does it cost for solar power systems in Iowa?

The price varies from $2.49 to $2.88, depending on the equipment size. For example, a 6 kW system unit costs $2.88/Watt, while a 20 kW system unit costs $2.49/Watt.1

Therefore, the solar system cost may be between $ 17,280 and $49,800 for 6 kW and 20 kW system units, respectively.

The main equipment you need to have a complete solar power system includes the following:

- Solar panels for house

- Batteries for storage or a connection to the grid

- An inverter

- Solar racking equipment

- Performance monitoring systems

Suppose you factor in the available solar incentives from the federal government, the state of Iowa, and other local companies. The solar power installation cost may be much lower than the estimated prices in that case.

Solar power by state may vary, and the solar panels lifespan may differ depending on where you live. You can factor in such measures before you start the residential solar project.

Solar Installation Calculator Costs

When installing solar panels in Iowa, choose a cost-effective option that meets all your energy needs. Choose the option with free solar installation or huge solar panels savings.

Sometimes, the cost may go higher than predicted, especially if you fail to consider important factors when calculating the estimated cost.3

Some of the factors include the following:

- What are the average energy requirements in your home?

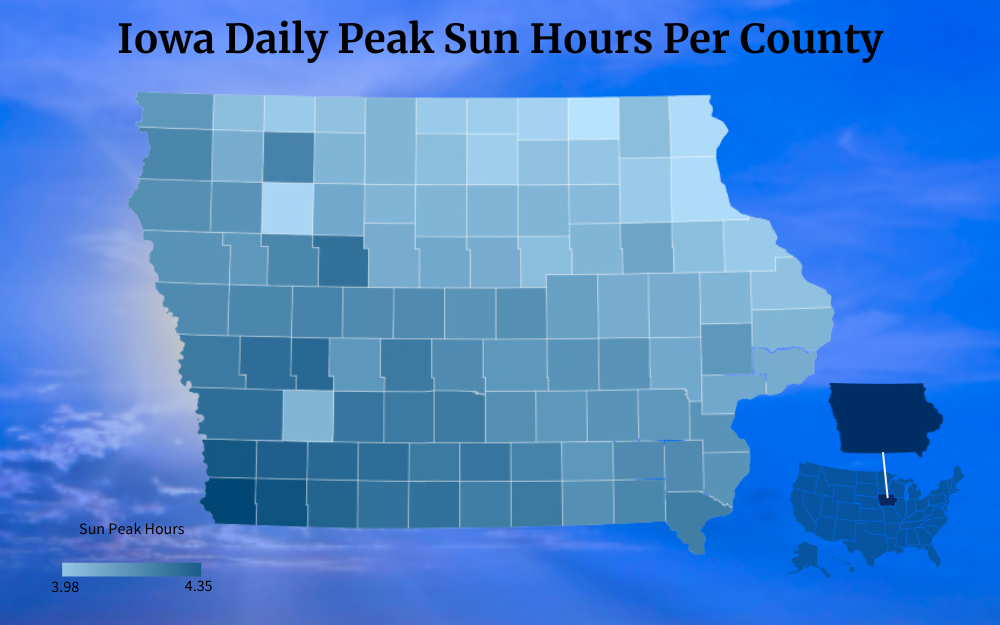

- How many hours of peak sunlight do you receive in your area?

- How efficient are the solar panels you want to buy?

- How big are the solar panels?

With these factors in mind, you can estimate how many solar panels you need for your home and won’t need to use a solar installation calculator costs application.

Step 1: Determine how many kilowatt-hours of electricity you need in your home every month.

Check your previous electricity bill and look for kilowatt-hours used in that month.

If the kilowatt hours are not shown, check for the meter readings and subtract last month’s reading from the most recent one. Take 1,500 kWh as an example for your monthly watt usage.

Step 2: Convert the monthly kilowatt-hour reading to a daily reading.

You need to calculate your daily energy use for a good estimate. Therefore, divide the monthly kilowatt-hours by the number of days a month.

So, if the month has 30 days, the calculations are 1,500 divided by 30. Hence, your daily energy usage is approximately 50 kWh.

Step 3: Determine how many hours of sunlight you get in your area.

In Iowa, the average peak hours of sunlight for a fixed solar panel is 4.55 hours.5

To calculate the energy production you need daily from your solar panels, divide the approximate daily energy usage by the number of sunlight peak hours.

50 divided by 4.55 to get 10.98 kW.

Step 4: Calculate the number of panels you need.

First, choose the size of the solar panel you need and determine its wattage.

Most solar panels in the U.S. have an energy rating of 200 to 400 Watts.14 Therefore, you can choose any panel size within that range to meet your needs.

For example, if you choose a 300 W solar panel for your solar system project, divide 300 by 1,000 to convert the watts into kilowatts.

So, 300/1,000 gives you 0.3 kW per panel.

You already know you can get 10.98 kW per panel daily, so you divide that by 0.3 kW to get the number of panels you need.

Therefore, it is 10.98/0.3 to get 36.6 panels.

Your solar system project requires 37 solar panels to meet all your energy needs throughout the month.

How Can Home Solar Reduce Your Electricity Bills?

Installing a solar power system in your home is one of the best ways to save on power bills. In Iowa, it’s a requirement that all residents with solar power systems sign up for net metering, which allows them to save more and enjoy a sustainable electricity supply all year round.10

Net metering works in two ways.

- Your excess energy from the solar panels is sent to your utility company, where it’s measured and credited to your account so you can utilize the bill in the future. For example, you can accumulate more credits in the summer when the sun is brightly shining and use them up in the winter when solar energy generation is low.

- Your excess energy from the solar panels is pumped into the grid and measured by your home meter. At night, when you pull out power from the grid, the measured energy ticks out the energy you spend.

At the end of the month, you only pay the net of what you consumed vs. what you pumped into the grid.

Net metering is an incredible incentive because it is one of the ways on how can home solar reduce your electricity bills monthly, even when you can’t rely on solar because of the weather.3

How To Find IA Solar Panels

When transitioning to solar power energy for your household, the rule of thumb is to ensure you use high-quality solar panels and engage a professional for installation services.16 A well-installed solar system can serve you for a long time, thus giving you value for your money while meeting your home’s energy requirements.

For instance, the average solar recovery period in Iowa is 12 years. So, your solar system should serve you longer and allow you to enjoy the benefits of your investment.1

Knowing how to find IA solar panels or installers is important and the following factors should be considered.

Qualifications and Certifications

An ideal solar panel provider or installer should be certified under industry standards and licensed to install residential solar systems in Iowa. If they work as part of a team or subcontract the project to other professionals, ensure that you check everyone’s qualifications to ascertain that they can install your solar power system.

Expertise

While a solar panel installer may be certified and licensed to operate, they may not be well-experienced in the job. Therefore, ensure that the provider or installer you choose has at least three years of experience in their portfolio and can answer questions about solar power systems.

An experienced installer can tell you the truth about solar panels, solar panel degradation, and the life expectancy of solar panels.

Pricing

It’s okay for different service providers to quote different prices for your solar system installation. However, some may overcharge you if you don’t have an estimate of how much it could cost you to complete the installation.

Ensure you choose a provider matching your installation budget per your estimated installation costs.

Transparency

When choosing a solar panel installer, it’s important to consider the person’s communication skills and transparency about the project. You don’t want to keep asking questions about every detail of the project but want someone who readily briefs you on the project’s progress and other minor details.

For example, a solar panel provider should transparently tell you how long are solar panels good for and how to dispose of solar panels if needed.

Reviews and Testimonials

When an installer offers excellent service, their clients likely go online and tell others about it. Unfortunately, it works the same if an installer does a terrible job.

Before choosing a solar panel installer, do your due diligence and try to find reviews and testimonials about them on popular review sites.

Going for solar power is an excellent option if you live in Iowa and want to reduce your monthly electricity bills. Although the installation cost may seem quite high, you can easily take advantage of available state incentives and enjoy lower prices.

Additionally, the federal government offers solar tax credit that can help you pay your taxes without hassle. This tax credit may come long after installation, but it’s a huge relief for homeowners and helps to save some money.

Not sure how to go about solar power system installation?

Ensure that you contact a professional in Iowa that can help you get started. Taking advantage of Iowa solar incentives can provide significant savings and make the transition smoother.

Frequently Asked Questions About Iowa Solar Incentives

Is Iowa a Good Place for Solar Panels?

Yes, Iowa receives an average of 4.55 hours of direct sunlight daily, making it a good place for solar panel installation. However, the amount of sunlight received on every home’s roof may differ and, therefore, should be considered before you start any installation project.

Does Iowa Have a Solar Tax Credit?

No, the Iowa solar tax credit program expired in 2021, and the state has yet to renew it. However, Iowa residents can now access the federal solar investment tax credit at 30% of their solar project cost.

How Many Times Can You Claim the Solar Tax Credit?

Federal solar panel tax credit is claimed only once and is used to offset your taxes for the year when you complete installing the solar power project. If the tax credit amount exceeds your taxes, the remaining amount carries over to the following year until the whole amount is used.

References

1EcoWatch Local Advisors. (2023). Solar panel cost guide in Iowa City, IA (2023 Update). Ecowatch. Retrieved September 7, 2023, from <https://www.ecowatch.com/solar/panel-cost/ia/iowa-city>

2Neumeister, K. (2023). What is the federal solar Tax Credit (ITC)?Ecowatch. Retrieved September 7, 2023, from <https://www.ecowatch.com/solar/incentives/federal-tax-credit>

3Ritland, K. (2022). 4 Factors to help determine your solar system size and output. Sun Valley Solar Solutions. Retrieved September 7, 2023, from <https://www.sunvalleysolar.com/blog/four-factors-to-help-determine-your-solar-system-size-and-output>

4SEIA. (2023). State solar spotlight – Iowa. Solar Energy Industries Association. Retrieved September 7, 2023 from <https://www.seia.org/sites/default/files/2023-01/Iowa.pdf>

5Turbine Generator. (2023). Iowa sunlight hours & renewable energy information. Turbine Generator. Retrieved September 7, 2023, from <https://www.turbinegenerator.org/solar/iowa/>

6Zagame, K. (2023). Do Iowa solar incentives make it affordable for homeowners to go solar? Ecowatch. Retrieved September 7, 2023, from <https://www.ecowatch.com/solar/incentives/ia>

7Matthews, L. (2022). Iowa solar incentives for 2023. Leafscore. Retrieved September 7, 2023, from <https://www.leafscore.com/solar-guide/benefits-of-going-solar/solar-rebates-and-incentives/iowa/>

8Zagame, K. (2023). How much do solar panels cost in Iowa? Ecowatch. Retrieved September 7, 2023, from <https://www.ecowatch.com/solar/panel-cost/ia>

9Hahn, D. (2023). How much do solar panels increase home value? Solar Reviews. Retrieved September 7, 2023, from <https://www.solarreviews.com/blog/do-solar-panels-increase-home-value>

10Josh. (2021). Iowa net metering – How does it work? Purelight Power. Retrieved from <https://purelightpower.com/blog/iowa/iowa-net-metering-how-does-it-work/>

11State of Iowa. (2023). Solar Energy System Tax Credits. Iowa Department Of Revenue. Retrieved September 8, 2023, from <https://tax.iowa.gov/solar-energy-system-tax-credits>

12State of Iowa. (2021, November 19). IDR Releases Updated Tax Guidance: Remote Sellers, Solar Energy Equipment. Iowa Department Of Revenue. Retrieved September 8, 2023, from <https://tax.iowa.gov/idr-releases-updated-tax-guidance-remote-sellers-solar-energy-equipment>

13State of Iowa. (2023). On-site (Distributed) Generation. Iowa Utilities Board. Retrieved September 8, 2023, from <https://iub.iowa.gov/regulated-industries/electric/site-distributed-generation>

14Center for Sustainable Systems, University of Michigan. (2023). Photovoltaic Energy Factsheet. Pub. No. CSS07-08. Retrieved September 8, 2023, from <https://css.umich.edu/publications/factsheets/energy/photovoltaic-energy-factsheet>

15Loan Programs Office. (2023). INFLATION REDUCTION ACT OF 2022. Department of Energy. Retrieved September 8, 2023, from <https://www.energy.gov/lpo/inflation-reduction-act-2022>

16Solar Energy Technologies Office. (2021, August 31). Decisions, Decisions: Choosing the Right Solar Installer. Department of Energy. Retrieved September 8, 2023, from <https://www.energy.gov/eere/solar/articles/decisions-decisions-choosing-right-solar-installer>

17City of Ames. (2023). Residential Programs. City of Ames. Retrieved September 18, 2023, from <https://www.cityofames.org/government/departments-divisions-a-h/electric/smart-energy/residential-programs>

18Photo by State of Iowa. State of Iowa Website. Retrieved from <https://tax.iowa.gov/solar-energy-system-tax-credits>